Petroleum Minister Karim Badawi announced on Sunday that Egypt had reduced its 2040 renewable energy target down from a previous goal of 58% to 40%, highlighting the fact that natural gas will continue to play a significant role in the nation’s energy mix for years to come.

Egypt promised to increase the percentage of renewable energy output in its energy mix to 42% by 2035 before hosting the COP27 climate meeting in 2022.

Later, the aim was advanced to 2030. Mohamed Shaker, the then-minister of electricity, unveiled a bold proposal in June 2024 to increase this to 58% by 2040; however, that goal has since been abandoned.

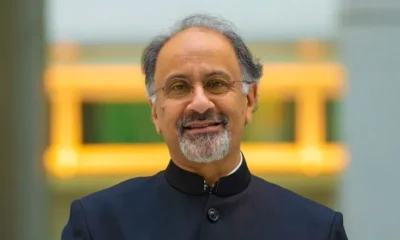

“This is a message to all of us to work together to increase discoveries and attract more investments through the bids being offered for exploration, aiming to achieve discoveries in the region, which holds more wealth, particularly natural gas,” Badawi said in the opening session of the Mediterranean Energy Conference 2024.

Egypt’s persistent dependence on fossil fuels coincides with efforts to regain the confidence of international oil companies, whose domestic activities ceased due to a shortage of hard currency that put the nation in debt to the tune of billions of dollars.

Since entering office in July, Badawi has met with many foreign energy corporations, such as Eni of Italy, which intends to increase production in Egypt’s largest gas field, Zohr, by digging additional wells in early 2025.

At its peak of 3.2 billion cubic feet per day (bcf/d) in 2019, Zohr’s gas output allowed the nation to turn a profit.

However, by early 2024, output had dropped to 1.9 bcf/d, forcing Egypt to import more gas through a pipeline connecting it to Israel and more LNG to avoid a months-long load-shedding program.

Additionally, Egypt imports fuel oil that contains sulphur; in September, imports reached a record-breaking 255,000 barrels per day (bpd), the highest level since at least 2016.

1 Comment