Rwanda has joined a list of African countries like Nigeria and Zimbabwe who have announced plans to tax online services and digital companies consumed within the country.

Earlier this week, the Federal Government of Nigeria announced plans to tax foreign digital service providers offering services such as Netflix, Google, YouTube, and Amazon.

Some of these service providers are video streaming sites, social media platforms, and companies that offer downloads of digital content. They are expected to pay digital tax to the Federal Inland Revenue Service.

The principle that allows international tax and cross-border activities was designed after the need for industrialization post WW11 in the 1920s and known as permanent establishment (PE) status.

The principle requires that a business only be taxed in a country where it creates sufficient physical presence. Since most companies in the digital economy can operate in a country without setting up appearances, the rule does not capture them.

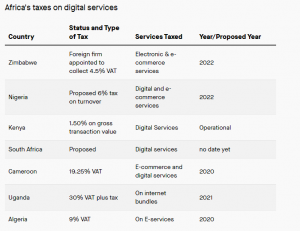

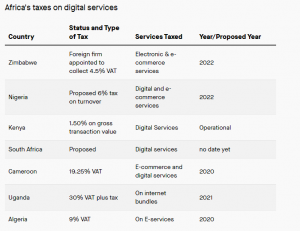

image culled from qz.com

According to the Rwanda Revenue Authority (RRA), a proposal has been presented before the Ministry of Finance and Economic Planning from where it will undergo several procedures before implementation if approved.

“When you pay for services such as Netflix, you are using money that you have generated in Rwanda. So, we are asking, why don’t we collect VAT on these services yet they are being paid for by our citizens? If you pay 12 dollars a month for Netflix, why don’t we keep some of that amount at the source here?” Jean-Louis Kaliningondo, the Deputy Commissioner General of RRA said.

“If you go to Western countries, for example, France, you find that Amazon pays VAT yet it is not a French company. European countries are collecting VAT on services provided by foreign platforms, he added.

In November 2021, Ghana announced plan to introduce 1.75% levy on all electronic transactions including on mobile money payments, bank transfers and merchant payments to widen the tax net.

A number of African countries have expanded the scope of their indirect taxes to cover digital services, but only a few have thus far implemented some form of direct digital services tax that applies to non-residents with no physical presence in their respective countries.

VenturesNow1 day ago

VenturesNow1 day ago

Politics1 day ago

Politics1 day ago

VenturesNow1 day ago

VenturesNow1 day ago

VenturesNow1 day ago

VenturesNow1 day ago