The International Monetary Fund (IMF) has predicted that inflation rate in Nigeria will drop to 23 per cent in 2025 with a further drop to 18 per cent by 2026 from the current rate of 33.20 per cent.

The IMF, which made the protection in its Global Economic Outlook released on Tuesday at the ongoing IMF/World Bank Spring Meetings in Washington D.C, said Nigeria was moving in the right direction with economic reforms including exchange rate reforms which it believes contributed to the surge in inflation rate in March.

The report endorsed by

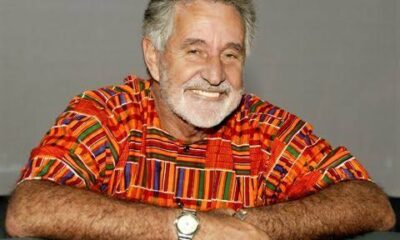

Division Chief, IMF Research Department, Daniel Leigh, noted that with oil prices being on the rise in part due to geopolitical tensions and services, inflation had remained stubbornly high in many countries, including Nigeria.

“We see inflation in (in Nigeria) declining to 23 per cent next year and then 18 per cent in 2026,” Leigh said.

“Growth in Nigeria, steady but actually rising this year, from 2.9 per cent last year to 3.3 percent this year. We have seen an expansion from the recovery in the oil sector, with a better security situation and also improved agriculture, benefiting from the better weather conditions and the introduction of dry season farming.

“So, there’s a broad based increase also in the financial sector, in the IT sector. Inflation, yes, it has increased.

“Part of this reflects the reforms, the exchange rate and its pass through into other goods from imports to other goods.

“So, this explains also why we revised up our inflation projection for this year to 26 per cent. But with the tight monetary policies and that interest rate increase, significant interest rate increases during February and March,” he added.

On his part, head of IMF Research Department, Pierre Olivier Gourinchas, said Nigeria has six to nine per cent inflation target which has been missed by over a decade, but he however, believes bringing inflation back to target should remain the priority for the country.

“There are stark divergences also between countries that call for careful calibration of monetary policy.

“Going forward, policymakers should prioritize measures that help preserve or even enhance the resilience of the global economy.

“A key priority is to rebuild fiscal buffers, especially in an environment with high real interest rates, modest growth, and elevated debts.

Unfortunately planned fiscal adjustments are often insufficient and could be derailed further given the record number of elections this year,” Gourinchas said.

Metro1 day ago

Metro1 day ago

Metro1 day ago

Metro1 day ago

Sports1 day ago

Sports1 day ago

Politics24 hours ago

Politics24 hours ago