Strictly Personal

10,000 rules that have tried ‑ and failed – to kill trade in the East African Community, By Charles Onyango-Obbo

Published

2 years agoon

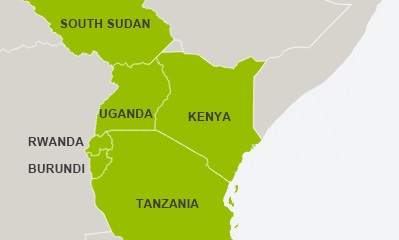

During the week, the business press in Nairobi, quoting a government paper, reported that Kenya and Tanzania had resolved 23 problematic regulations that slowed down trade between the two countries since President Samia Suluhu Hassan visited Kenya in May 2021.

The non-tariff barriers (NTBs) ranged from rules on licences to quotas, embargoes, foreign exchange restrictions and import deposits. The reports made the point that a lot of progress had been made.

It can be difficult to imagine that there were still as many as 23 rules hindering trade between two East Afriacan Community economies, but that is if you haven’t heard the full story.

The resolution of those 23 squabbles brought the number of cumulative NTBs that were sorted and eliminated to 256 by end of June 2022.

Those 256, however, are not even the tip of the iceberg. An expert who studies the bewildering rules East African bureaucrats have imposed on what — on paper — is supposed to an open the Common Market told me there are nearly 1,000 of them governing just food trade in the EAC!

At that rate, if one adds up the regulations that get in the way of trade in the region, which include countless national legislations in the seven EAC partner states, not just the stuff in the EAC protocols, there could well be 10,000 of them.

During the week, the business press in Nairobi, quoting a government paper, reported that Kenya and Tanzania had resolved 23 problematic regulations that slowed down trade between the two countries since President Samia Suluhu Hassan visited Kenya in May 2021.

The non-tariff barriers (NTBs) ranged from rules on licences to quotas, embargoes, foreign exchange restrictions and import deposits. The reports made the point that a lot of progress had been made.

It can be difficult to imagine that there were still as many as 23 rules hindering trade between two East Afriacan Community economies, but that is if you haven’t heard the full story.

The resolution of those 23 squabbles brought the number of cumulative NTBs that were sorted and eliminated to 256 by end of June 2022.

Those 256, however, are not even the tip of the iceberg. An expert who studies the bewildering rules East African bureaucrats have imposed on what — on paper — is supposed to an open the Common Market told me there are nearly 1,000 of them governing just food trade in the EAC!

At that rate, if one adds up the regulations that get in the way of trade in the region, which include countless national legislations in the seven EAC partner states, not just the stuff in the EAC protocols, there could well be 10,000 of them.

That is 10,000 reasons why there isn’t free flow of trade in the EAC. To see the impact they are having, consider what happened when Kenya and Tanzania dealt with just those two dozen NTBs.

The reports noted that trade between Kenya and Tanzania crossed the Ksh100 billion (nearly $808 million) mark for the first time. Multiply that across the EAC and you are looking at billions of dollars left on the table because of NTBs.

If East Africa truly swung its markets open, there would be a lot of money swishing around, jobs galore for youth, and booming economies generating a lot of taxes for the politicians to feed on. It is a mystery that this national economic interest is still trumped by nationalism and small-minded protectionism.

With thousands of these trade-hampering regulations, for most business to be done, customs and other officials at the border have to behave like traffic police in most of East Africa. Most people don’t realise it, but the traffic rules in the region, going back to the colonial period, are a mountain. New rules have only piled on old ones.

There are thousands of rules, down to the colour of cars, ride height, tyre type, extinguishers, wattage of lights, tools that should be in a car, drivers’ vision, and so forth which, if enforced 100 percent, there would be no cars on East Africa’s roads.

Today, you will roll up to an EAC border point, and cross into the next country while eating roast maize or a fresh mango and no one will flag you down. If you read the rules in detail, that is not permissible. Happily, the rules are sometimes overcome by bewildering borders too.

Arua is a hectic city in northwest Uganda, situated strategically between the country’s borders with the Democratic Republic of Congo and South Sudan.

A few kilometres out of Arua, the official Uganda-DRC customs post is Vurra. It’s not as famous as Namanga, Busia, Malaba, Katuna/Gatuna, or Nimule, and no fancy one-stop border post has been built there yet.

However, it’s a fascinating little devil of a border. When you get past the boom gate on the Uganda side, you head into DRC. But that is only if you turn right. Despite having crossed the gate, if you turned left you would remain in Uganda. If you stay left, you are essentially governed by a different logic about the border, than if you if go right.

There is nothing stopping the Ugandan chap who turned left from turning right into DRC a kilometre in, or to hand a packet of maize flour to his Congolese mistress. Yet, somehow, an invisible order keeps most people in their right territorial lane.

Not always, though.

In 2021, Uganda closed the Vurra customs post for two months after Congolese youth crossed and erected a barrier and other structures 300 metres inside Uganda, claiming it was part of DRC territory. It didn’t make regional or international news. All attention was still on the Katuna (Gatuna in Rwanda) border that had been closed at that point for two years.

The matter was solved with little drama. When the border reopened, as we saw with Katuna/Gatuna last year, the people on both sides went into wild celebrations. The confusion of the Congolese youth about the border line, and the reluctance of the Ugandan authorities to use a hammer to resolve the “incursion,” was understandable.

Besides the big trucks carrying fuel and other goods to the DRC and South Sudan, the most common trade vehicles on the roads there are the lorries, young people perched on top, carrying Ugandan cattle to the borders. Some of them come from as far as western Uganda, ferrying cattle to South Sudan. It is a surprisingly orderly and big business. If the weird rules about livestock trade were enforced, perhaps not a single animal would cross the border.

And the local Congolese and South Sudan elite would miss out on their beef steak. Thank goodness for common sense, and some cross-border pragmatism.

It would be wonderful the day that spirit infected all of East African trade.

Charles Onyango-Obbo is a journalist, writer, and curator of the “Wall of Great Africans”. Twitter@cobbo3

You may like

-

Mastercard partners Diamond Trust Bank to boost digital payments in East Africa

-

Borders should unite us, not divide us, By Andrea Aguer Ariik Malueth

-

Cut to undersea cable causes internet disruptions across East, Southern Africa

-

Our leaders need to develop an EAC character that abhors NTBs, By Joachim Buwembo

-

IMF eases East Africa’s indebted states’ burden with $1.9b deals

-

As Germany’s Chancellor rounds off African tour, its President begins own tour in Tanzania

Strictly Personal

Let’s merge EAC and Igad, By Nuur Mohamud Sheekh

Published

4 weeks agoon

November 27, 2024

In an era of political and economic uncertainty, global crises and diminishing donor contributions, Africa’s regional economic communities (RECs) must reimagine their approach to regional integration.

The East African Community (EAC) and the Intergovernmental Authority on Development (Igad), two critical RECs in East Africa and the Horn of Africa have an unprecedented opportunity to join forces, leveraging their respective strengths to drive sustainable peace and development and advance regional economic integration and promote the African Continental Free Trade Area (AfCFTA).

Already, four of the eight Igad member states are also members of the EAC and, with Ethiopia and Sudan showing interest, the new unified bloc would be formidable.

Igad’s strength lies in regional peacemaking, preventive diplomacy, security, and resilience, especially in a region plagued by protracted conflicts, climate challenges, and humanitarian crises. The EAC, on the other hand, has made remarkable strides in economic integration, exemplified by its Customs Union, Common Market, and ongoing efforts toward a monetary union. Combining these comparative advantages would create a formidable entity capable of addressing complex challenges holistically.

Imagine a REC that pairs Igad’s conflict resolution strengths with the EAC’s diplomatic standing and robust economic framework. Member states of both are also contributing troops to peacekeeping missions. Such a fusion would streamline efforts to create a peaceful and economically prosperous region, addressing the root causes of instability while simultaneously promoting trade investment and regional cooperation.

These strengths will be harnessed to deal with inter-state tensions that we are currently witnessing, including between Ethiopia and Somalia over the Somaliland MoU, strained relations between Djibouti and Eritrea, and the continually deteriorating relations between Eritrea and Ethiopia.

The global economy experienced as a result of the COVID-19 pandemic, compounded by the Ukraine war and competing global crises, has strained donor countries and reduced financial contributions to multilateral organisations and African RECs. Member states, many of which are grappling with fiscal constraints, are increasingly unable to fill this gap, failing to make timely contributions, which is in turn affecting key mandate areas of Igad and EAC, and staff morale.

A merger between Igad and EAC would alleviate this financial pressure by eliminating redundancies. Shared administrative systems, integrated programmes, and a unified leadership structure would optimise resources, enabling the new REC to achieve more with less. Staff rationalisation, while sensitive, is a necessary step to ensure that limited funds are channelled toward impactful initiatives rather than duplicative overheads.

The African Union (AU) envisions a fully integrated Africa, with RECs serving as the building blocks of the AfCFTA. A unified EAC-Igad entity would become a powerhouse for regional integration, unlocking economies of scale and harmonising policies across a wider geographical and economic landscape.

This merger would enhance the implementation of the AfCFTA by creating a larger, more cohesive market that attracts investment, fosters innovation, and increases competitiveness. By aligning trade policies, infrastructure projects, and regulatory frameworks, the new REC could serve as a model for others, accelerating continental integration.

The road to integration is not without obstacles. Political will, divergent institutional mandates, and the complexity of harmonising systems pose significant challenges. However, these hurdles are surmountable through inclusive dialogue, strong leadership, and a phased approach to integration.

Member states must prioritise the long-term benefits of unity over short-term political considerations. Civil society, the private sector, the youth, and international partners also have a critical role to play in advocating for and supporting this transformative initiative.

The time for EAC and Igad to join forces is now. By merging into a single REC, they would pool their strengths, optimise resources, and position themselves as a driving force for regional and continental integration. In doing so, they would not only secure a prosperous future for their citizens and member states but also advance the broader vision of an integrated and thriving Africa.

As the world grapples with crises, Africa must look inward, embracing the power of unity to achieve its potential. A combined Igad-EAC is the bold step forward that the continent needs.

Nuur Mohamud Sheekh, a diplomatic and geopolitical analyst based in London, is a former spokesperson of the Igad Executive Secretary. X: @NuursViews

Strictly Personal

Budgets, budgeting and budget financing, By Sheriffdeen A. Tella, Ph.D.

Published

1 month agoon

November 20, 2024

The budget season is here again. It is an institutional and desirable annual ritual. Revenue collection and spending at the federal, State and local government levels must be authorised and guided by law. That is what budget is all about. A document containing the estimates of projected revenues from identified sources and the proposed expenditure for different sectors in the appropriate level of government. The last two weeks have seen the delivery of budget drafts to various Houses of Assembly and the promise that the federal government would present its draft budget to the National Assembly.

Do people still look forward to the budget presentation and the contents therein? I am not sure. Citizens have realised that these days, governments often spend money without reference to the approved budget. A governor can just wake up and direct that a police station be built in a location. With no allocation in the budget, the station will be completed in three months. The President can direct from his bathroom that 72 trailers of maize be distributed to the 36 states as palliatives. No budget provision, and no discussion by relevant committee or group.

We still operate with the military mentality. We operated too long under the military and of the five Presidents we have in this democracy, two of them were retired military Heads of State. Between them, they spent 16 years of 25 years of democratic governance. Hopefully, we are done with them physically but not mentally. Most present governors grew up largely under military regimes with the command system. That is why some see themselves as emperor and act accordingly. Their direct staff and commissioners are “Yes” men and women. There is need for disorientation.

The importance of budget in the art of governance cannot be overemphasized. It is one of the major functions of the legislature because without the consideration and authorisation of spending of funds by this arm of government, the executive has no power to start spending money. There is what we refer to as a budget cycle or stages. The budget drafting stage within the purview of the executive arm is the first stage and, followed by the authorisation stage where the legislature discusses, evaluates and tinkers with the draft for approval before presenting it to the President for his signature.

Thereafter, the budget enters the execution phase or cycle where programmes and projects are executed by the executive arm with the legislature carrying out oversight functions. Finally, we enter the auditing phase when the federal and State Auditors verify and report on the execution of the budgets. The report would normally be submitted to the Legislature. Many Auditor Generals have fallen victim at this stage for daring to query the executives on some aspects of the execution in their reports.

A new budget should contain the objectives and achievements of the preceding budget in the introduction as the foundation for the budget. More appropriately, a current budget derives its strength from a medium-term framework which also derives its strength from a national Development Plan or a State Plan. An approved National Plan does not exist currently, although the Plan launched by the Muhammadu Buhari administration is in the cooler. President Tinubu, who is acclaimed to be the architect of the Lagos State long-term Plan seems curiously, disillusioned with a national Plan.

Some States like Oyo and Kaduna, have long-term Plans that serve as the source of their annual budgets. Economists and policymakers see development plans as instruments of salvation for developing countries. Mike Obadan, the former Director General of the moribund Nigeria Centre for Economic and Management Administration, opined that a Plan in a developing country serves as an instrument to eradicate poverty, achieve high rates of economic growth and promote economic and social development.

The Nigerian development plans were on course until the adoption of the World Bank/IMF-inspired Structural Adjustment Programme in 1986 when the country and others that adopted the programme were forced to abandon such plan for short-term stabilisation policies in the name of a rolling plan. We have been rolling in the mud since that time. One is not surprised that the Tinubu administration is not looking at the Buhari Development Plan since the government is World Bank/IMF compliant. It was in the news last week that our President is an American asset and by extension, Nigeria’s policies must be defined by America which controls the Bretton Woods institutions.

A national Plan allows the citizens to monitor quantitatively, the projects and programmes being executed or to be executed by the government through the budgeting procedure. It is part of the definitive measures of transparency and accountability which most Nigerian governments do not cherish. So, you cannot pin your government down to anything.

Budgets these days hardly contain budget performance in terms of revenue, expenditure and other achievements like several schools, hospitals, small-scale enterprises, etc, that the government got involved in successfully and partially. These are the foundation for a new budget like items brought forward in accounting documents. The new budget should state the new reforms or transformations that would be taking place. Reforms like shifting from dominance of recurrent expenditure to capital expenditure; moving from the provision of basic needs programmes to industrialisation, and from reliance on foreign loans to dependence on domestic fund mobilisation for executing the budget.

That brings us to the issue of budget deficit and borrowing. When an economy is in recession, expansionary fiscal policy is recommended. That is, the government will need to spend more than it receives to pump prime the economy. If this is taken, Nigeria has always had a deficit budget, implying that we are always in economic recession. The fact is that even when we had a surplus in our balance of payment that made it possible to pay off our debts, we still had a deficit budget. We are so used to borrowing at the national level that stopping it will look like the collapse of the Nigerian state. The States have also followed the trend. Ordinarily, since States are largely dependent on the federal government for funds, they should promote balanced budget.

The States are like a schoolboy who depends on his parents for school fees and feeding allowance but goes about borrowing from classmates. Definitely, it is the parents that will surely pay the debt. The debt forgiveness mentality plays a major role in the process. Having enjoyed debt forgiveness in the past, the federal government is always in the credit market and does not caution the State governments in participating in the market. Our Presidents don’t feel ashamed when they are begging for debt forgiveness in international forum where issues on global development are being discussed. Not less than twice I have watched the countenance of some Presidents, even from Africa, while they looked at our president with disdain when issues of debt forgiveness for African countries was raised.

In most cases, the government, both at the federal and state cannot show the product of loans, except those lent by institutions like the World Bank or African Development Bank for specific projects which are monitored by the lending institutions. In other cases, the loans are stolen and transferred abroad while we are paying the loans. In some other cases, the loans are diverted to projects other than what the proposal stated. There was a case of loans obtained based on establishing an international car park in the border of the State but diverted to finance the election of a politician in the State. The politician eventually lost the election but the citizens of the State have to be taxed to pay the loan. Somebody as “Nigeria we hail thee”.

Transformation in budgeting should commence subsequently at the State and federal level. Now that local government will enjoy some financial autonomy and therefore budgeting process, they should be legally barred from contracting foreign loans. They have no business participating in the market. They should promote balanced budget where proposed expenditures must equal the expected revenues from federal and internal sources. The State government that cannot mobilise, from records, up to 40 percent of its total budget from IGR should not be supported to contract foreign loans. The States should engage in a balanced budget. The federal government budget should shift away from huge allocations to recurrent expenditure towards capital expenditure for capital formation and within the context of a welfarist state.

Sheriffdeen A. Tella, Ph.D.

EDITOR’S PICK

Ghana’s Afua Asantewaa begins second GWR sing-a-thon attempt

Ghanaian singer, Afua Asantewaa, on Saturday, began her second attempt at breaking the Guinness World Record (GWR) for the longest...

20 African tech-preneurs embark on Korean innovation tour

The African Development Bank Group’s Innovation and Entrepreneurship Lab has selected 20 promising tech entrepreneurs from various African technology ventures...

Zambia: Expert warns of food security threat due to climate change

A prominent Zambian climate-smart agriculture expert, Oliver Bulaya, has warned of a collapse of the county’s agricultural sector with a...

Outrage over murder of Nigerian beaten to death by South Africans inside estate security office

The Nigerian community, under the auspices of Nigerian Citizens Association in South Africa (NICASA), has raised the alarm over the...

Moroccan annual inflation rises to 0.8% in November

Morocco’s statistics office has confirmed that the country’s annual inflation rate, as determined by the consumer price index, increased from...

Swiss company Mercuria partners Zambia’s IDC in new metals trading firm

According to a statement released by Swiss commodities trader, Mercuria, on Thursday, it has established a metals trading arm with...

Nigerian activist remanded in prison for threatening President’s son

A Nigerian court has ordered a female activist, Olamide Thomas, to be remanded in prison custody for allegedly issuing a...

Zambian law association kicks over suspension of two members

The Law Association of Zambia (LAZ) has kicked against the suspension of two of its council members, Arnold Kaluba, the...

FIFA Ranking: Nigeria ends 2024 as fifth best team in Africa

Nigeria’s men’s football national team, the Super Eagles, ended the year 2024 as the fifth best team in Africa in...

Burkina Faso releases 4 French spies after Moroccan intervention

In a diplomatic spat over their imprisonment, France and Morocco announced Thursday that four French nationals detained in Burkina Faso...

Trending

-

VenturesNow1 day ago

VenturesNow1 day agoMoroccan annual inflation rises to 0.8% in November

-

Musings From Abroad1 day ago

Musings From Abroad1 day agoSwiss company Mercuria partners Zambia’s IDC in new metals trading firm

-

Metro1 day ago

Metro1 day agoNigerian activist remanded in prison for threatening President’s son

-

Metro6 hours ago

Metro6 hours agoOutrage over murder of Nigerian beaten to death by South Africans inside estate security office