The Tanzanian horticultural industry has recieved a grant of $2.1 million from TradeMark Africa to enable it boost its market expansion.

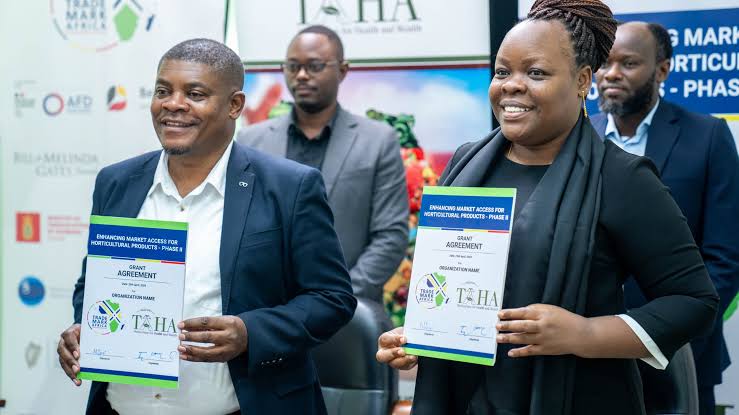

According to TradeMark Africa’s Regional Director for East and Central Africa, Ms. Monica Hangi, the Tanzania Horticultural Association (TAHA) and TradeMark signed a grant agreement to initiate the Phase II of their collaborative project

“The Phase I of the project which ran from January 2019 to June 2023, yielded tangible results, with 27,854 farmers (35% women, 65% men, and 40% youth) linked to markets, and approximately 50,000 tons of horticultural products worth roughly TZS 42.7 billion (US$18.3 million) sold.

“This second phase, backed by a $2.1 million (Tzs 5.4billion) grant from TMA funded by the Foreign, Commonwealth & Development Office (FCDO), Norway, and Ireland, spans three years and focuses on advancing market access, promoting sustainable trade practices, and empowering local farmers in the horticultural industry,” she said in a statement on Wednesday.

Hangi noted that despite notable successes recorded with the first phase, the sector continues to face substantial challenges, including limited financing access, climate change impacts, and inadequate market information, which could hinder growth.

“These challenges necessitate a united approach from both the government and private sector, incorporating policy support, research and development investment, and development sector initiatives aimed at improving market and credit access for farmers,” she said.

She added that the grant highlighted the significance of supporting the horticultural sector, particularly in mitigating unemployment among youth and women.

“Our commitment through this substantial grant is to upscale production, increase export volumes, and, consequently, job opportunities, thereby reinforcing Tanzania’s standing in the global horticultural market,” said Hangi

Culture2 days ago

Culture2 days ago

Tech2 days ago

Tech2 days ago

Tech21 hours ago

Tech21 hours ago

Sports2 days ago

Sports2 days ago