Strictly Personal

Naira and February feast of vultures, By Lasisi Olagunju

Published

1 year agoon

The naira exchange affliction of 1984 rose up a second time in 2022 and spilled into 2023 because it has always been the choice of Nigeria to submit to vultures. Don’t fail to listen to Chief Bola Tinubu who philosophised in Osogbo last week that despite the rains beating the vulture since the very beginning, “it has not died; it has not fallen ill but has been taking offerings and eating sacrifices.” That is true. The hands of the Nigerian rains are too weak to stop the vulture – strong, tenacious, bald-headed bird of prey. Unlike James Hadley Chase’s, the Nigerian vulture is not patient; it is also not Kevin Carter’s vulture; it won’t wait on any starving girl to die before feasting on her corpse. From petrol stations to banking halls, birds of prey are on the prowl, scavenging for the remains of Nigeria.

“History repeats itself, first as tragedy, second as farce.” In case you are like me and you often wonder what Karl Max meant with that expression, let me give some dictionary definitions of the key words there: A ‘tragedy’ “shows the downfall of a hero and does not have a happy ending.” A ‘farce’ “is a comedy in which everything is absolutely absurd.” As we struggle in banks for new naira notes just as we did 39 years ago, Karl Max, who issued that warning about history, tragedy and farce, would look at what we’ve done with our lives and shake his head. The 1984 outing of our hero in Abuja was tragic; the present is a farce. Yet, we’ve learnt nothing – we hail him as he raises tremulous hands at campaigns and announces winners before contests. A tragic farce is in rehearsal. And the hero does his predatory acting while the poor faint on petrol and naira queues.

Our children are lucky; they and their fathers got months of notice in 2022 from President Muhammadu Buhari on a transition from old naira notes to new ones. We and our fathers got two days’ notice in 1984 from General Muhammadu Buhari for a similar exercise. On Monday, 23 April, 1984, the Buhari government announced a sudden currency change with effect from Wednesday, 25 April, 1984. “The exchange will commence at commercial banks and at central bank branches at 8 a.m on Wednesday, the 25th of April, 1984 and will be completed at 6 p.m on Sunday, the 6th of May, 1984,” Buhari’s deputy, Tunde Idiagbon, told us in a special broadcast laden with tough talk on Monday, 23rd April. “Naira takes new colour” was how the Nigerian Tribune of April 24, 1984 reported what the government did. Nigerians were ordered to take their naira notes of N20, N10, N5 and N1 to the bank in exchange for new ones. All land borders were closed.

The then CBN governor, Abdulkadir Ahmed, directed that “individuals could exchange up to a maximum of N5,000 per person from any bank irrespective of whether or not the person is an account holder in that bank.” The CBN boss added that “exchange shall be by way of either payment into an account or direct across-the-counter exchange.” But then, in 1984, we took what we had to the bank and went back home empty-handed. Well, not entirely empty handed; receipts were issued to millions who had no bank accounts. But those pieces of paper could feed no one who held them, and so, there was an epidemic of hunger in the land. The currency exchange exercise lasted exactly 12 days – less than two weeks. There was no deadline extension. It was very hard depositing the old notes; it was harder retrieving the replacement from the banks. After the deadline, it became ‘now your suffering continues.’ People suffered; people died; some survived but got wrecked – and I will retell some of the harrowing stories here and now.

Banks remained riotous throughout last week and there were street protests, some with the fury of naked fire. The banks were rowdy also in April, May, June, 1984. Things were so bad that a bank in Ibadan put up a notice that customers who were dissatisfied with the guideline that they could not withdraw any amount above N50 should lodge their complaint with the Central Bank. A customer told a reporter that the bank’s notice was “rude and insulting since we did not bank with the Central Bank.” What we suffered that time was more than that insult. The rain was not a drizzle; it poured. ‘Banks ration money’ was how the Nigerian Tribune headlined its report on the experience on Friday, May 11, 1984: “Many Nigerians are starving because they do not have money to buy basic necessities of life, including foodstuffs. This is because commercial banks are not releasing enough money after the currency exchange exercise…At the Nigeria-Arab Bank in Ibadan, some customers whose cheques were accepted were told to come back today. The customers were informed by a bank official that they were expecting money from the Central Bank. One of the customers, Mr. Koya Salako, told the Nigerian Tribune that he had been going to the bank since Tuesday without receiving any amount. At the National Bank, Dugbe, no customer could withdraw more than N50. At the Union Bank, Dugbe, the people were allowed to withdraw between N100 and N200. At African Continental Bank. Dugbe, some customers went home disappointed yesterday as they could not withdraw even N100. None of the customers was attended to as there was no money to pay them. A man who claimed to have been at the bank since 7.30am yesterday said ‘I have deposited over N4,000 with them and I have got no money to maintain my family again. Please, tell them to give me N100 only for the time being.’”

That was 39 years ago.

Last week in Delta State, a bank customer slumped and died after standing for hours in a queue at a bank in Agbor. The police said “he was not trying to withdraw cash; he came to collect his ATM card.” That was tragic. People slumped on queues in 1984 but I can’t remember any of them dying. About two weeks after the currency exchange deadline, a woman slumped at the Cooperative Bank, Ibadan on Tuesday, May 15, 1984. She regained her consciousness later and told the people who revived her that she had not eaten for two days. “Sympathisers, however, called a food hawker and gave the woman her first meal in two days while bank officials paid her N50 instead of N150 she intended to withdraw from her account” (see Nigerian Tribune, May 16, 1984). Again, I said earlier that people died. It was real. ‘Man commits suicide’ was the lead headline of the Nigerian Tribune of June 5, 1984. The report: “A middle-aged man committed suicide in Ibadan last Wednesday following what sources described as ‘series of hopeless visits to his bank for cash.’ The partly decomposed body of Mr. K. O (I withhold the name), a 48-year old civil servant of the accounts department of the Oyo State Ministry of Information, Youths, Sports and Culture, was found dangling under the ceiling fan in one of his rooms three days after his death. A suicide note left on a stool in the room showed that he decided to end his life out of frustration. The deceased was said to have collapsed twice on the premises of a bank and was rushed home on each occasion without cash. Last Monday, May 28, two days before he committed suicide, somebody had given him N2 (two naira) after narrating his ordeal. An ulcer patient, the deceased was said to have complained about taking only pap, his regular meal since he couldn’t withdraw cash from his bank. His remains were laid to rest on Monday at the public cemetery, Sango, Ibadan. Contacted on telephone on Monday, the state Police Commissioner, Mr. Archibong Nkana, simply said: ‘I think there was something like that.’” The suicide note left behind by the deceased reads: “Do not forget that I have insisted that the receipt of the purchased stationery is in the steel cabinet. I’m sorry I have to end up this way but I think that is the only way open to me…” In 2015, we brought back the leader who staged that tragedy. He is leading his party’s campaigns for a renewal of the values he represents this month.

‘A Feast of Vultures’ is a 2016 book by Indian investigative journalist, Josy Joseph. The author says it is “an angst-ridden narrative on the distortion of our democracy.” It is a story told in frightening details of how politicians, business people and shadowy principalities buy and sell and proceed to own that country. He could as well be referring to Nigeria. That is the picture I got when Tinubu held the microphone in Osogbo last week and, with cavalier affection, cuddled vulture as the totem of our democracy: “They want to victimize us, but the rains have been beating our vulture for a long time. Despite the rains, vulture has not died; it has not fallen ill but has been taking offerings and eating sacrifices. Try vulture again, if it will not eat sacrifices.” Indeed, what we have seen since this naira nonsense is enough to make carrion of a nation – food for vultures. And the coming election is a definite feast for hungry carnivores and impatient ravens. Raptors of all hues are already in the skies, wheeling and doing deals. They’ve made of the country a living dead – what the Romans called vivi mortui. As my US-based professor told me, with every sector in turmoil, it is almost impossible to help Nigeria. “The country has become a low trust society. No one can fix a low trust family, a low trust community, a low trust nation. If a family runs on a low trust, each time the man leaves the house, it is wahala; each time the woman leaves, wahala. You remember Evans, the billionaire kidnapper? In Nigeria, I change my drivers as I change clothes because I don’t know when one has become Evans.” But a day is enough for a bad choice to act really badly. Indeed, the next president of Nigeria may be an Evans – unless a Deus ex Machina descends to arrest the free-fall.

‘Cashless’ has a new meaning in Nigeria. It means having money in your bank account but having no access to it because either the banks have no cash or bankers are hoarding cash and the banks’ online platforms are down. I was at my bank on Friday to cash the N20,000 withdrawal limit decreed by the CBN. I was offered a limit of N2,000. I excused myself and left with smiles. I remembered 1984. Nigerians prayed against shame but shame has shot down that prayer; the focus now is how to survive this regime of pains. People now use naira to buy naira: they transfer one thousand, five hundred naira to get cash of one thousand naira; or they transfer 11 thousand naira to get 10 thousand naira cash. What really is the cost of being a Nigerian living in Nigeria?

Leaders are like bank notes; the more you recycle them, the dirtier they come. I compared notes with a friend on the 1984 experience and we agreed that despite the horrible experience of that time, it was still better managed than the fiasco we have in 2023. In 1984, local government sole administrators were directed to act as bankers for rural folks where there were no banks. And there are no records of theft of poor people’s money. The council bosses collected old notes from the unbanked and gave them their values in new notes. There will be a festival of laughter if a governor suggests that arrangement today. Everyone blames everyone else for our crisis of existence. PDP blames APC; APC blames PDP; the president and the CBN blame commercial banks for the scarcity of naira notes. Everyone with links to the kitchen is denying knowledge of how the kitchen knife got lost.

In November 1799, Napoleon Bonaparte seized absolute power and established a dictatorship in France. Freedom lovers groaned and grumbled. But, 52 years later, in 1851, the people watched and hailed as his nephew, Napoleon III, seized absolute power again; then Max dropped his eternal words that have become a warning in all seasons of anomie: “History repeats itself, first as tragedy, second as farce.” Do we have a third chance? American art historian and critic, Hal Foster, in 2020, wrote the book ‘What Comes after Farce?’ I adopt his words and ask what comes for Nigeria after this farcical farce?

You may like

-

We will handle planned nationwide protests as family matter— Nigerian Govt

-

Shelve your planned protest, I’m addressing your grievances, Tinubu begs Nigerian youths

-

Dangote Refinery in crude supply negotiations with Libya

-

Nigeria: Presidency warns against planned nationwide protest, accuses opposition

-

Meta faces $220 million fine from Nigeria for breaking consumer, data rules

-

Nigerian govt to spend N3tn on new minimum wage, pensions, gratuities— Minister

Strictly Personal

All eyes in Africa are on Kenya’s bid for a reset, By Joachim Buwembo

Published

5 days agoon

July 21, 2024

Whoever impregnated Angela Rayner and caused her to drop out of school at the tender age of 16 with no qualifications might be disappointed that we aren’t asking who her baba mtoto (child’s father) is; whether he became a president, king or a vagabond somewhere, since the girl ‘whose leg he broke’ is now UK’s second most powerful person, 28 years since he ‘stole her goat’.

Angela’s rise to such heights after the adversity should be a lesson to countries which, six decades after independence, still have millions of citizens wallowing in poverty and denied basic human dignity, while the elite shamelessly flaunt obscene luxury on their hungry, twisted faces.

After independence, African countries also suffered their adolescent setbacks in the form of military coups. Uganda’s military rule lasted eight years, Kenya’s about eight hours on August 1, 1982, while Tanzania’s didn’t materialise and its first defence chief became an ambassador somewhere.

What we learn from Angela Rayner is that when you’re derailed, it doesn’t matter who derailed you, because nobody wants to know. What matters is that you pick yourself up, not just to march on, but to stand up and shine.To incessantly blame our colonial and slave-trading ‘derailers’ while we treat our fellow citizens worse than the colonialists did only invites the world to laugh. Have you ever read of a colonial officer demanding a bribe from a local before providing the service due?

African countries today need to press ‘reset’. A state operates by written policies, plans, strategies and prescribed penalties with gazetted prisons for those who break the rules. This is far more power than teenage Angela had, so a reset state should take less time to become prosperous than the 28 years it took her to get to the top after derailing.

So it’s realistic for countries to operate on five-year planning and electoral cycles, so a state that fails to implement a programme in five years has something wrong with it. It needs a reset.

A basic reset course for African leaders and economists should include:

1. Mindset change: Albert Einstein teaches us that no problem can be solved from the same level of consciousness that created it. For example, if you are in debt, seeking or accepting more debt is using the same level of thinking that put you there. If you don’t like Einstein’s genius, you can even try an animal in the bush that falls into a hole and stops digging. Our economists are certainly better than a beast in the bush.

2. Stealing is wrong: African leaders and civil servants need to revisit their catechism or madarasa – stealing public resources is as immoral as rape.

3. Justifying wrong doesn’t make it right: Using legalese and putting sinful benefits in the budget is immoral and can incite the deprived to destroy everything.

4. Take inventory of your resources and plan to use them: If Kenya, for example, has a railway line running from Mombasa to Nairobi, is it prudent to borrow $3.6 billion to build a highway parallel to it before paying off and electrifying the railway?

If Uganda is groaning under a $2 billion annual petrol import bill, does it make sense to beg Kenya for access to import more fuel, when Kampala is already manufacturing and marketing electric buses, while failing to use hundreds of megawatts it generates, yet the country has to pay for the unused power?

If Tanzania… okay, TZ has entered the 21st Century with its electric trains soon to be operating between Dar es Salaam and Morogoro. Ethiopia, too, has connected Addis Ababa to the port of Djibouti with a 753-kilometre electric railway, and moves hundreds of thousands of passengers in Addis every day by electric train.

5. Protect the environment: We don’t own it, we borrowed it from our parents to preserve it for our children. Who doesn’t know that the future of the planet is at stake?

6. Do monitoring and evaluation: Otherwise you may keep doing the same thing that does not work and hope for better results, as a sage defined lunacy.

7. Don’t blame the victims of your incompetence: This is basic fairness.

We could go on, but how boring! Who doesn’t know these mundane points? We are not holding our breath for Angela’s performance, because if she fails, she will be easily replaced. Africa’s eyes should now be on Kenya to see how they manage an abrupt change without the mass bloodshed that often accompanies revolutions.

Strictly Personal

The post-budget crisis in Kenya might be good for Africa, after all, By Joachim Buwembo

Published

2 weeks agoon

July 10, 2024

The surging crisis that is being witnessed in Kenya could end up being a good thing for Africa if the regional leaders could step back and examine the situation clinically with cool-headed interest. Maybe there is a hand of God in the whole affair. For, how do explain the flare not having started in harder-pressed countries such as Zambia, Mozambique and Ghana?

As fate would have it, it happened in East Africa, the region that is supposed to provide the next leadership of the African Union Commission, in a process that is about to start. And, what is the most serious crisis looming on Africa’s horizon? It is Debt of course.

Even the UN has warned the entire world that Africa’s debt situation is now a crisis. As at now, three or four countries are not facing debt trouble — and that is only for now.

There is one country, though, that is virtually debt-free, having just been freed from debt due to circumstances: Somalia. And it is the newest member of the East African Community. Somalia has recently had virtually all its foreign debt written off in recognition of the challenges it has been facing in nearly four decades.

Why is this important? Because debt is the choicest weapon of neocolonialists. There is no sweeter way to steal wealth than to have its owners deliver it to you, begging you, on all fours, to take it away from them, as you quietly thank the devil, who has impaired their judgement to think that you are their saviour.

So?

So, the economic integration Africa has embarked on will, over the next five or so years, go through are a make-or-break stage, and it must be led by a member that is debt-free. For, there is no surer weapon to subjugate and control a society than through debt.

A government or a country’s political leadership can talk tough and big until their creditor whispers something then the lion suddenly becomes a sheep. Positions agreed on earlier with comrades are sheepishly abandoned. Scheduled official trips get inexplicably cancelled.

Debt is that bad. In African capitals, presidents have received calls from Washington, Paris or London to cancel trips and they did, so because of debt vulnerability.

In our villages, men have lost wives to guys they hate most because of debt. At the state level, governments have lost command over their own institutions because of debt. The management of Africa’s economic transition, as may be agreed upon jointly by the continental leaders, needs to be implemented by a member without crippling foreign debt so they do not get instructions from elsewhere.

The other related threat to African states is armed conflict, often internal and not interstate. Somalia has been going through this for decades and it is to the credit of African intervention that statehood was restored to the country.

This is the biggest prize Africa has won since it defeated colonialism in (mostly) the 1960s decade. The product is the new Somalia and, to restore all other countries’ hope, the newly restored state should play a lead role in spreading stability and confidence across Africa.

One day, South Sudan, too, should qualify to play a lead role on the continent.

What has been happening in Kenya can happen in any other African country. And it can be worse. We have seen once promising countries with strong economies and armies, such as Libya, being ravaged into near-Stone Age in a very short time. Angry, youthful energy can be destructive, and opportunistic neocolonialists can make it inadvertently facilitate their intentions.

Containing prolonged or repetitive civil uprisings can be economically draining, both directly in deploying security forces and also by paralysing economic activity.

African countries also need to become one another’s economic insurance. By jointly managing trade routes with their transport infrastructure, energy sources and electricity distribution grids, and generally pursuing coordinated industrialisation strategies in observance of regional and national comparative advantages, they will sooner than later reduce insecurity, even as the borders remain porous.

EDITOR’S PICK

Trevor Noah set for ‘Off the Record’ world tour

South African comedian and talk show host, Trevor Noah, has announced a date for his “Off The Record” global tour...

SA mobility startup LULA acquires UK-based Zeelo’s operations

South Africa’s mobility startup, LULA, has announced the acquisition of the operations of UK-based Zeelo in a move that will...

Ngannou accuses Joshua of employing dirty tactics in their fight in Saudi Arabia

Former UFC heavyweight champion, Francis Ngannou, has accused British-Nigerian boxer, Anthony Joshua, and his promotion team of employing unfair and...

#EndBadGovernance Protests: Please be patient with Tinubu’s govt, monarchs beg Nigerian youths

Some prominent traditional rulers in Nigeria have pleaded with Nigerian youths and organizers of the planned nationwide #EndBadGovernance protests scheduled...

UNESCO removes Senegal’s Niokolo-Koba National Park from list of World Heritage sites in danger

The United Nations’ Educational, Scientific and Cultural Organization (UNESCO) has removed Senegal’s Niokolo-Koba National Park from the list of World...

At Project Aliyense discourse, panelists call for balance between free speech, ethical considerations

The government has been urged to balance freedom of speech with ethical considerations and laws that prevent harm to others....

Adenia Partners acquires Air Liquide’s operations in 12 African countries

Adenia Partners, a leading private equity firm, has completed the acquisition of Air Liquide’s operations in 12 African countries, adopting...

We will handle planned nationwide protests as family matter— Nigerian Govt

The Nigerian government says it will handle the planned #EndBadGovernance protests scheduled to commence on August 1 as a family...

Veteran Nigerian entertainer Charly Boy vows to divorce wife if Kamala Harris doesn’t win US presidential election

Veteran Nigerian entertainer, Charles Oputa, popularly known as Charly Boy, has vowed to divorce his wife of 47 years if...

Saudi club Al Hilal places African transfer record bid for Osimhen

Saudi Arabia club side, Al-Hilal, have reportedly made an African transfer record bid for Super Eagles and Napoli striker, Victor...

Trending

-

Sports1 day ago

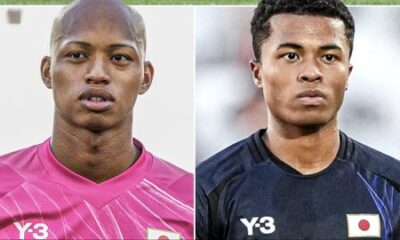

Sports1 day agoMeet Nigerian-born players doing big things for Japan at Paris 2024 Olympics

-

Metro2 days ago

Metro2 days agoWe will handle planned nationwide protests as family matter— Nigerian Govt

-

Metro15 hours ago

Metro15 hours ago#EndBadGovernance Protests: Please be patient with Tinubu’s govt, monarchs beg Nigerian youths

-

Tech2 days ago

Tech2 days agoAdenia Partners acquires Air Liquide’s operations in 12 African countries