Zambian opposition party, the Socialist Party (SP), has accused the ruling United Party for National Development (UPND) of masterminding the abduction of its candidate for the Kaunga Ward by-election in Luangwa district of Feira Constituency, Maneya Mwale.

The SP, in a statement in Lusaka, also called on security agencies to arrest the UPND’s Lusaka Province Chairperson, Obvious Mwaliteta, for the alleged abduction of Mwale.

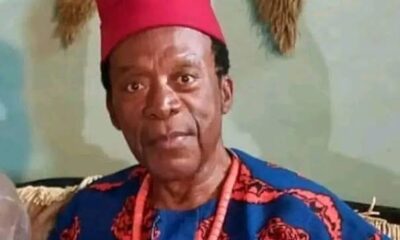

SP’s Vice President, Dr Cosmas Musumali, said Mwaliteta should be arrested together with his District Chairperson, Anderson Banda.

Musumali, who made the call at a media briefing in Lusaka, alleged that Mwaliteta, Banda and other people mentioned kidnapped his party’s candidate.

He also accused the ruling party and President Hakainde Hichilema of being behind such activities that had continued to happen in all the ward elections in the country.

“Those who know this President know that he micromanages everything. He has hands on type of leadership and this kidnapping have not happened once but have been happening, nothing has been done, no one has been arrested, what’s the conclusion, the conclusion is that he is okaying it, he sees nothing wrong with it and the Head of State who swore to uphold the rights and Constitution of Zambia,” Musumali said.

“This is something that can not be done without HH tolerating it, facilitating it and even giving it a go ahead. If it’s done once I would agree with you that some rogue UPND members did it outside his control,” Musumali added.

He also claimed that the UPND was not ready to uphold the democratic tenets of the country and were using all means necessary to win the elections.

“The candidate in Kaunga Ward, like in the other 6 Wards, was abducted during the nominations day, which forced the Socialist Party to look for other candidates and Hichilema has remained silent on such activities,” Musumali noted.

Musumali further called on the Electoral Commission of Zambia to invalidate the nominations for Chikenge and Chisanga wards and set a new date for filling in of nominations.

“We further demand that the Commission should ban the UPND from participating in these two wards due to the crimes committed, which are against the electoral code of conduct,” he demanded.

He expressed that “hell would have broken lose had it been the other way round, and that Socialist Party leader Dr Fred M’membe would have been called all sorts of names by the UPND and their surrogates.”

“This is the winning formular for the UPND, kidnapping, abductions have become child’s play for them, they are endangering people’s lives, you have the audercity to abduct a 22 years old girl and pointing a gun to her head,” Musumali said.

Musings From Abroad2 days ago

Musings From Abroad2 days ago

Tech1 day ago

Tech1 day ago

Culture1 day ago

Culture1 day ago

Politics2 days ago

Politics2 days ago