Tech

4 Kenyan Startups Make It To Final Round Of Visa’s Everywhere Initiative

Leading fintech companies from the Sub-Sahara Africa (SSA) technology startup community have made it to the finals of Visa’s Everywhere Initiative, a global innovation program that tasks start-ups to solve commerce challenges of tomorrow, further enhance their own product propositions and provide visionary solutions for Visa’s vast network of partners

-

Sports1 day ago

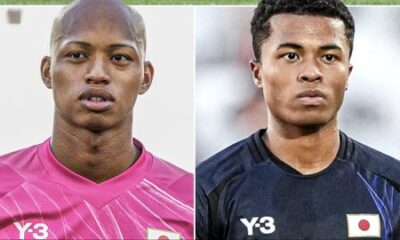

Sports1 day agoMeet Nigerian-born players doing big things for Japan at Paris 2024 Olympics

-

Metro2 days ago

Metro2 days agoWe will handle planned nationwide protests as family matter— Nigerian Govt

-

Tech2 days ago

Tech2 days agoAdenia Partners acquires Air Liquide’s operations in 12 African countries

-

Metro16 hours ago

Metro16 hours ago#EndBadGovernance Protests: Please be patient with Tinubu’s govt, monarchs beg Nigerian youths