As the effect of the Russia/Ukraine war bites harder in Europe, the continent is exploring alternatives for products it once relied on Russia for, one of such is coal, and Africa is once again considered the go-to spot for energy resources.

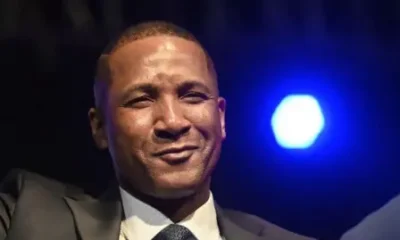

President Mokgweetsi Masisi of Botswana on Tuesday claimed the ongoing war has forced Europe to pivot more to Africa for energy resources.

“We have received inquiries from Europe and so we want to (export),” Masisi said in an interview in Cape Town, where he was a key speaker at the Mining Indaba conference.

Masisi said Botswana has seen demand from both governments and the private sector in Europe and estimates that demand from Europe could reach more than 50,000 tonnes a month.

Botswana holds 106 million tons (MMst) of proven coal reserves as of 2016, ranking 59th in the world and accounting for about 0% of the world’s total coal reserves of 1,139,471 million tons (MMst). Botswana has proven reserves equivalent to 78.4 times its annual consumption.

Lefoko Moagi, Minister of Mineral Resources, Green Technology, and Energy Security, said in the same interview that Botswana could meet that demand, while Masisi said it wanted to do so “as soon as possible.”

“Typically what we’ve been getting is 50,000 tonnes a month is what they want to get, but we’ve also had others (inquiring about) long-term contracts, (we are) looking at a million tonnes a year from individual countries (combined),” Moagi said.

However, President Masisi emphasized that all parties were committed to reducing carbon emissions in line with the Paris Agreement on climate change.

“So, clearly, there will be some responsibility arrangements in how to use the coal so that we don’t cause a lot of pollution,” he said.

Botswana has been bombarded with inquiries to supply coal to Europe and estimates that demand from Western countries could top a million tonnes a year.

Politics2 days ago

Politics2 days ago

VenturesNow2 days ago

VenturesNow2 days ago

VenturesNow2 days ago

VenturesNow2 days ago

Metro1 day ago

Metro1 day ago