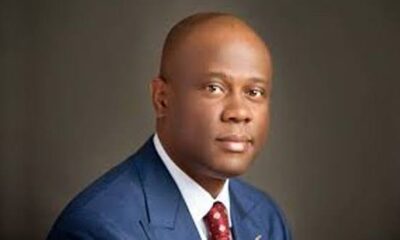

The Managing Director and Chief Executive Officer (CEO), of Nigerian tier-one financial institution, Access Bank Plc., Herbert Wigwe, is set to earn a whopping sum of N1.1 billion in dividends accruing from his direct and indirect holdings in the bank and its subsidiaries in Nigeria, and globally.

A breakdown of the final declared dividends of the bank stands at 70 kobo per share, following a 30 kobo interim dividend declared in the half year period of 2021.

From his overall holdings, Wigwe is set to earn N140.86 million from direct holdings, and N921.63 million from his indirect holdings, which brings his total earnings for 2021 to N1.1 billion.

Going by the breakdown from the registrars of Nigerian lender bank, as at December 31, 2021, Wigwe alone held 1.52 billion units of shares in the bank which is 4.6% of the total shares of the bank as listed on the Nigerian Stock Exchange.

Wigwe’s direct shares with the bank stands at 201.23 million shares, while he also owns a total of 1.32 billion units of shares through third parties.

A further breakdown of the Access Bank CEO’s direct and indirect holdings shows that he actually controls 537.73 million units of Access Bank’s shares through United Alliance Company of Nigeria, 584.06 million shares units through Trust and Capital Limited, and 194.83 million shares through Coronation Trustees Tengen, Mauritius.

The shrewd business mogul will therefore, receive a total of N1.52 billion as total dividend for the 2021 financial year, 25% higher than the N1.21 billion he received in the previous year, and will also earn N455.36 million from the interim dividend paid in the half-year period of 2021.

According to its audited account for the year 2021, Access Bank grew its profit after tax by 51.13% year-on-year to N160 billion in 2021, while it earned N601.70 billion, from its lending business as Interest income grew by 22.99% from N489.22 billion.

The bank also grew its deposits from customers by 24.47% to N6.95 trillion, while its assets rose to N11.73 trillion.

Politics2 days ago

Politics2 days ago

Metro2 days ago

Metro2 days ago

Metro10 hours ago

Metro10 hours ago

Metro1 day ago

Metro1 day ago