President Mokgweetsi Masisi of Botswana told JCK News that the country may increase its ownership stake in the world’s largest diamond miner, De Beers, following the announcement by parent firm Anglo American that it intended to spin off or sell the company.

De Beers is 15% owned by the government, and 70% of the company’s yearly supply of raw diamonds comes from Botswana.

To stave off an acquisition by larger rival BHP Group, Anglo revealed a radical evaluation of its operations that included selling or divesting the diamond business to concentrate on copper, iron ore, and a fertilizer project in the UK.

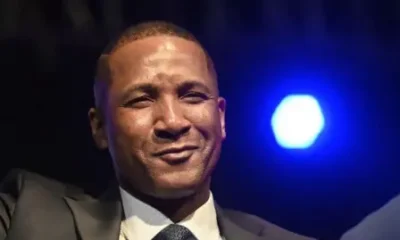

Masisi stated that, should it occur, Anglo’s sale of De Beers would be “the best thing” to JCK in Las Vegas. According to Masisi, “if it’s attractive to,” the government may increase its stake in De Beers. This was stated by the online diamond news station. The government would protect its interests in diamond mining, the president said in a May interview with CNBC Africa.

An IPO for the diamond industry is one of the strategies Anglo may take into consideration, according to Reuters, which quoted sources on May 14.

Like other luxury goods, diamond prices have been hammered by a slump in global demand. De Beers has been limiting supply and offering flexibility to contracted customers. In February, Anglo announced a $1.6 billion impairment charge, on De Beers. Anglo acquired De Beers in 2011, buying the Oppenheimer family’s 40% stake for $5.1 billion.

Masisi told JCK News Botswana’s ideal partner in De Beers would be a long-term investor. The government will try to keep the “bad guys out” and wants investors whose vision is aligned with the government’s.

“One of the characteristics of a bad owner is someone who has impatient capital,” Masisi said. “This industry requires somebody who is in it for the long-haul, because it has its ups and downs.”

Politics2 days ago

Politics2 days ago

Metro2 days ago

Metro2 days ago

Metro10 hours ago

Metro10 hours ago

Metro1 day ago

Metro1 day ago