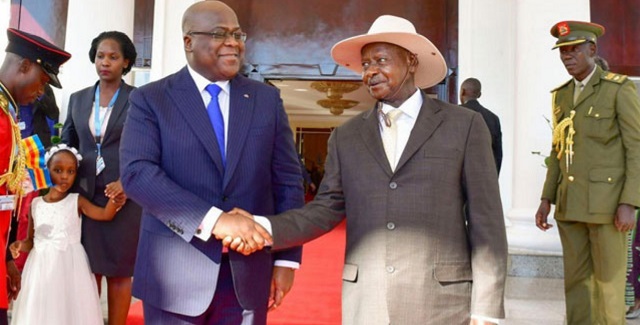

According to the Ministry of Finance’s Performance of the Economy report, Uganda had the largest trade surplus with the Democratic Republic of the Congo (DRC) in January, totalling $53.07 million (Ush208.9 billion).

The report, which summarises the monthly performance of several economic sectors, found that the Democratic Republic of the Congo (DR Congo) was the recipient of more exports from Uganda than any other member state of the East Africa Community (EAC), followed by South Sudan ($41.68 million, or Sh164 billion), Rwanda ($23.1, or Sh90.9 billion), and Burundi ($5.25 million, or Sh20.6 billion).

Uganda did, however, report deficits of $88.41 million (Ush348 billion) with Tanzania and $12.39 million (Ush48.7 billion) with Kenya. Meanwhile, exports to its EAC partner states increased to $231.47 million during the performance period, while its imports remained at $209.17 million.

With 37.6% of the total market share, the EAC continued to be Uganda’s top export destination, followed by the EU and the Middle East. Uganda, however, trades at a $267.64 million deficit with Asia, $118.15 million with the rest of Africa, and $6.64 million with Europe.

According to the Ministry of Finance report, Uganda’s total export revenue in December was $616.36 million, up 0.2% from $615 million in November of the previous year. This increase was mostly attributable to higher export revenues from cotton, tobacco, and simsim.

A 6.7% decrease in coffee exports from $470.68 million was recorded as a result of heavy rains delaying harvests and drying out freshly harvested coffee.

Between November 2023 and December 2023, the value of imports fell by 3.1% to $886.24 million, mostly as a result of decreased imports from the private sector, which included, among other things, wood and wood products, electricity, petroleum products, and animals.

With China and India being the main contributors, accounting for 61.9% of the region’s imports, Asia continued to be Uganda’s largest source of imports, accounting for 41.2% of the country’s total imports.

Other noteworthy regions with respective shares of 23.6%, 15.1%, and 10.2% were the Middle East, the East African Community, and the rest of Africa.

Metro2 days ago

Metro2 days ago

Sports2 days ago

Sports2 days ago

Metro1 day ago

Metro1 day ago

Culture2 days ago

Culture2 days ago