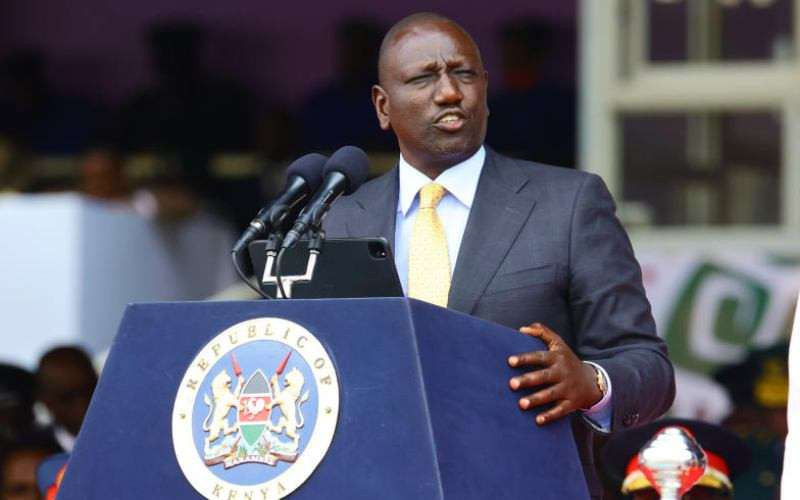

President William Ruto of Kenya told journalists on Tuesday that the country was trying to buy back at least some of its $2 billion Eurobond in February or March, putting an end to any possibility that it would default.

Kenya’s capacity to repay the bond, which matures in June, has come under scrutiny due to declining hard currency reserves, a sharp decline in the value of the local currency, and revenue difficulties.

Ruto said that although the government’s transaction consultants had eventually advised against it, Kenya would buy back $300 million of the Eurobond before the end of 2023, as he had assured the parliament in November.

“What they have recommended is that we do a buyback in February or March, and then we go to the market,” he said in an interview in Rome on the sidelines of the Italy-Africa summit.

“Thank God they were right. In fact, the markets have opened for Kenya, as they have for most other countries,” Ruto said.

The yields on dollar bonds issued by frontier nations have begun to decline in recent months, following a two-year surge driven by worries about high interest rates and heavy debts in advanced economies. With two oversubscribed bonds this month, Ivory Coast was able to raise $2.6 billion.

Additionally, as previously announced, Ruto stated that the government was no longer depending on the Trade and Development Bank (TDB), an organisation that provides development funding in Africa, to arrange a $1 billion syndicated loan for Kenya.

The remaining monies had not yet been provided, according to the finance minister of Kenya, who stated earlier this month that TDB had lent Kenya $210 million of the total.

“Because of the situation that we now see in the market, we believe that it would be a lot easier for us to raise that money in the market rather than through syndication,” Ruto said.

Metro2 days ago

Metro2 days ago

Metro2 days ago

Metro2 days ago

Musings From Abroad2 days ago

Musings From Abroad2 days ago

Sports2 days ago

Sports2 days ago