Oil marketers and the Nigerian Midstream and Downstream Petroleum Regulatory Authority expect refined petroleum product prices to reduce as another public refinery in Warri begins operations.

The marketers made the prediction when the Nigerian National Petroleum Company Limited launched the 125,000-barrel-per-day Delta State WRPC. NNPCL also wants to export locally refined goods for foreign cash. Last month, the 60,000-barrel-per-day Port Harcourt Refinery in Rivers State began operations.

During an inspection tour of the facility on Monday, the NNPCL Group Chief Executive Officer, Mele Kyari, explained that the inspection aimed to show Nigerians the level of work completed so far.

During a tour with NMDPRA CEO Farouk Ahmed and NNPC Board Chairman Pius Akinyelure, Kyari said that while facility repairs were not yet 100% complete, refining operations had begun and would produce straight-run kerosene, diesel and naphtha.

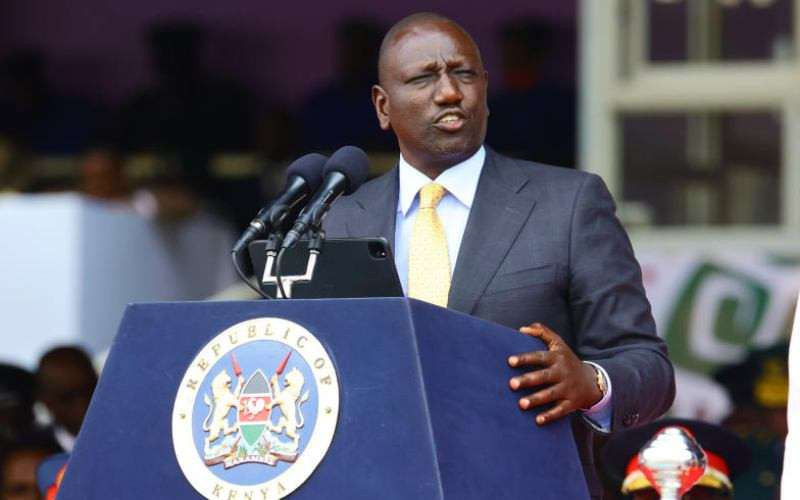

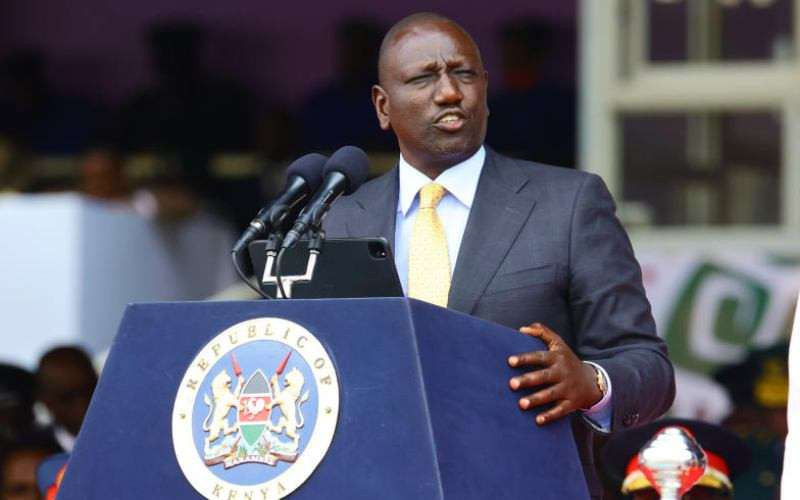

In a statement commemorating the milestone, President Bola Tinubu stated the plant is functioning at 60% or 75,000 barrels per day.

Kyari said, “We are taking you through our plant. This plant is running. Although it is not 100 per cent complete, we are still in the process. Many people think these things are not real. They think real things are not possible in this country. We want you to see that this is real.”

Since some of these goods would be shipped to foreign markets, he said, the reopening of the Warri refinery will help the country become a net exporter of petroleum products.

“Secondly, this plant had three stages; we have started plant one, which we call Area One. It can produce AGO (diesel), kerosene, naphtha, and a blend of crude oil. These are high-grade quality products required in the country, and we may need to export them. So this will give us cash, this company will make money and the promise of Mr President that this country must be a net exporter of petroleum products is already happening. Some of these products will go into the international market.

“Most importantly, I must put on record that Mr President believes that we can get this to work and get them to start and gave us the charge that we must start all three refineries. It’s already happening; we have started the 60,000 barrels per day refinery, and Area One of the Warri refinery is already working. Other plants that would produce PMS are being streamed and they would also come alive.

Mustapha Zarma, the Independent Petroleum Marketers Association of Nigeria’s National Operations Controller, stated that the rivalry in the downstream oil industry will become more fierce.

There will undoubtedly be a further decrease in pricing if the plant begins producing goods in bulk, he stated. This is because the market will ultimately be influenced by market forces and there will be fierce rivalry.

Until recently, none of Nigeria’s publicly owned refineries has worked to capacity for years, despite several investments to revive them. The failure of the government to revive them contributed to the high level of national anticipation surrounding the Dangote refinery whose operations appear to have revolutionalised the industry.

The refinery will concentrate on manufacturing and storing essential goods, such as heavy and light naphtha, automotive petrol oil and straight-run kerosene.

The country’s first fully owned refinery, the WRPC, was put into service in 1978 and is situated in Warri, Delta State, Nigeria. It was first built to process 100,000 barrels of crude oil a day, but in 1987 it was updated to process 125,000 barrels.