VenturesNow

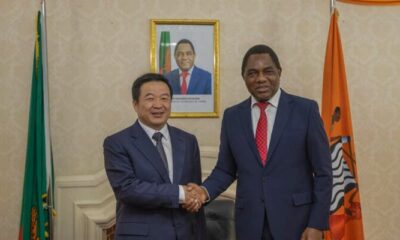

IMF approves 2nd assessment of Zambian debt facility, to release $184 million

VenturesNow

Food prices drive second straight monthly hike in Nigeria’s inflation

VenturesNow

MTN financial report reveals drop in group service revenue

-

VenturesNow2 days ago

VenturesNow2 days agoMTN financial report reveals drop in group service revenue

-

VenturesNow2 days ago

VenturesNow2 days agoNigeria’s $700bn mining potential attracts investors worldwide

-

VenturesNow2 days ago

VenturesNow2 days agoFood prices drive second straight monthly hike in Nigeria’s inflation

-

Metro2 days ago

Metro2 days agoMorocco’s Mpox test gets African CDC endorsement