Strictly Personal

How China’s demands at debt talks are adversely affecting Zambian Economy – A Critical Analysis, By Mwansa Chalwe Snr

Published

1 year agoon

The Monetary Policy Committee (MPC) of the Bank of Zambia in its Statement of 15 February 2023, has confirmed beyond reasonable doubt that China’s latest demands at the debt restructuring talks have started to adversely affect the Zambian economy. The Monetary Policy Statement demonstrated the adverse effects that the stalled debt restructuring talks were having on the economy, in terms of the exchange rate, interest rates, inflation, and job creation, due to the uncertainty. The 2022 economic stabilisation gains are all at risk of reversal, if no urgent diplomatic action is taken by Zambia.

Rapid depreciation of the Kwacha

The demand by China that Zambia’s local currency government bonds held by foreign investors, should be included in the deal, and has particularly contributed to the rapid depreciation of the kwacha, which has resulted in the increase of fuel prices and public transport fares. The kwacha exchange rate, is Zambia’s most important economic metric as it affects all Zambians regardless of their status because Zambia is an import dependent country

The Bank of Zambia’s statement shows that the demands by China have contributed to the reversal of the gains that the Kwacha made in 2022, which earned it the title of the best performing currency in the world. The Kwacha has been depreciating against the dollar almost every day for two months now, and it is at its weakest in nearly a year, as talks drag on with no end in sight.

“After a cumulative appreciation of 10.0 percent in the previous two quarters, the Kwacha depreciated by 4.3 percent against the US dollar to an average of K16.71 in the fourth quarter of 2022. The depreciating trend in the Kwacha has persisted in 2023, with the Kwacha trading at K19.33 per US dollar as at February 14.

“Foreign financial institutions, that had typically been suppliers of foreign exchange, are now more pronounced on the demand side as they are divesting from the domestic market. This is principally due to tighter global financial conditions, negative sentiments associated with the protracted debt restructuring negotiations and uncertainty around the treatment of non-resident holders of Government securities,” the Bank of Zambia Statement said.

Higher inflation outlook for 2023

The Central Bank has also revised its inflation outlook for 2023.It has partially attributed the forecasted higher inflation to China’s demand to have Zambian foreign investors in local bonds to be included in the restructuring deal.

“Over the forecast horizon, inflation is projected to increase and remain above the 6 – 8 percent target range. Inflation is now projected to average 11.1 percent in 2023 compared to the November 2022 forecast of 8.5 percent,” The Bank of Zambia Governor, Dr. Denny Kalyalya said. “Negative sentiments arising from the protracted debt restructuring negotiations (and more so the uncertainty over the treatment of the non-resident holders of Government securities) are also projected to add to elevated inflationary pressures.”

Forecast Economic activity and job Creation

The Bank of Zambia has increased the benchmark monetary policy rate to 9.25% from 9.0%. And it recently increased the statutory reserve ratio to 11.5 percent on commercial banks’ deposit liabilities, in order to support the depreciating kwacha. These measures will negatively affect the economy. The cost of borrowing (interest rates) will go up, and there will be continued shortage of liquidity in the economy, which will result in lower economic activity like last year and fewer jobs created.

Geo-political dimension to the debt talks and China’s demands

There is something that most Zambians do not seem to understand about the restructuring talks. There is a chess game that is being played between the US and China, with Zambia being the pawn in the game – which I predicted in my book two years ago. There is clearly a stealth “war” going on between the West/US and China in these debt restructuring talks. And if anyone thinks geo-politics and economics is not at play in the current talks, they must be either quite naïve or have not been following geopolitics of the past twenty years. They are well advised to go research and read more.

China cannot be blamed for its current demands because it is merely pursuing its self-interest by using its economic power in negotiations. China, is in some way, leading other emerging economies in trying to reform the global system for restructuring sovereign debt, which currently excludes multilateral banks like the World Bank. In general, China wants respect and recognition commensurate with its current status as the number one bilateral lender, the number two world economy, and Zambia’s largest bilateral creditor, and the key to the restructuring deal.

The Chinese seem to be pursuing a two pronged strategy in the debt restructuring negotiations, in as far as their demands are concerned. This can only be deciphered by experts on the subject. One is aimed at the West, to pursue reforms in sovereign restructuring, and the other is aimed at the Zambian government so that China can protect its turf which is under some apparent threat.

China has made repeated calls at the restructuring talks and in press conferences, for the World Bank and other multilateral development banks to participate in debt reductions. This demand is clearly targeted at the Parish Club and G7 countries in the debt negotiations.

On the other hand, China is demanding the almost impractical condition, of foreign investors in Zambia’s local currency bonds, to be part of the restructuring deal. This demand is clearly aimed at the Zambian government. It is the clearest sign yet to Zambia that it should directly engage with China at the highest level in order to allay the perception that Zambia has outsourced negotiations to Western countries and institutions. It is designed to put economic pressure on Zambia to act.

This week, Zambians will be on the edge watching the proceedings of the G20 finance minister’s central bank governors meetings in Bengaluru, India, from Feb. 23-25. They will be waiting for the outcome of the talks. The meeting’s agenda will include a debt round table discussion on Feb. 25, which China is part of. This has been organized by the host India, the IMF, and the World Bank. It will discuss broader issues that are creating roadblocks to debt relief deals for Zambia, Sri Lanka, and other countries.

During the G20 meetings in India, the US Secretary of Treasury, Janet Yellen, is expected to focus on unblocking debt restructuring talks and press China to speed up its debt relief for Zambia. The US government’s expectation is to see a deal struck on Zambian debt at these meetings. And the US embassy in Lusaka has echoed the same sentiments: “As Zambia’s largest bilateral creditor and as a co-chair of Zambia’s official creditor committee under the G20 Framework, China has an excellent opportunity to follow through on its announced commitment by moving expeditiously to restructure Zambia’s debt so all Zambians can begin benefiting from inclusive economic growth without delay.”

How to unlock the debt restructuring talks

On the basis of past experience, and knowing how the Chinese operate, it is unlikely that they will be swayed and greatly influenced by appeals from their geopolitical rival, the US or the Bretton Woods institutions-International Monetary Fund and World Bank in making their decisions on the deal.

Last year, the new Chinese Ambassador to Zambia Du Xiaohui disclosed that China never wanted to join the G20 Creditors Committee because it believes that friendly bilateral cooperation is the best way to deal with debt between friends. It had to take a direct phone call from Zambian President Hakainde Hichilema on 31 May, 2022 to Chinese President Xi Jinping to unlock the stalemate. And within two weeks, on the 16th June, 2022, the first Official Creditors Committee (OCC) meeting was held after over six months of failure, following the provisional approval of Zambia’s $1.3billion IMF deal on 3 December, 2021.

And following the aforementioned phone call, the Chinese Foreign Affairs Ministry released a statement about what President Xi Jinping had told President Hichilema. The contents of the statement gives a cue of what Zambia needs to do, to unlock the debt restructuring deal.

“The two sides should strengthen strategic communication and policy synergy, fully implement the nine programs of the Forum on China-Africa Cooperation (FOCAC), deepen mutually beneficial cooperation in various fields, promote more Zambian goods, especially quality agricultural products, to enter the Chinese market, and strengthen anti-pandemic cooperation. Both sides should carry forward the Tanzania-Zambia Railway (Tazara) spirit, keep it updated in accordance with the trend of the times, and make Tazara an important transportation channel in the region. The two sides should adhere to independent foreign policy, firmly safeguard international fairness and justice, and uphold the international system with the United Nations at its core and the international order underpinned by international law,” The Statement said.

Conclusion

President HH should find it easy to arrange a meeting to unlock the deal with China for a number of reasons. First, he did not publicly criticise China during the 2021 general elections campaign, unlike some other previous Zambian Presidential candidates. Two, he must have established some good rapport with President Xi Jinping through last year’s telephone conversation. And in general, there has been no express antagonism between Zambia and China since he became President. The deadlocked debt restructuring talks provides him with a great opportunity to recalibrate Zambia’s relationship with China. READ MORE:https://www.lusakatimes.com/2021/07/27/zambia-china-economic-ties-need-recalibration/

President Hakainde Hichilema, has repeatedly stated that his administration intends to continue with the tradition long-established by his predecessors of upholding the all-weather friendship between Zambia and China, and so it should not be too difficult to engage China at Presidential level.

China is Zambia’s big “brother”. The two’s relationship dates back to Zambia’s pre-independence. It is a sixty eight (68) year old relationship, dating back to 1955.The deal is so easy to unlock, if Zambia directly approaches China at the highest level. And this is the appropriate timing for which nobody would be faulted.

The writer is a Chartered Accountant, Author and an independent financial commentator and analyst.

You may like

-

Luapula businessman, Munsanje, reflects on media freedoms and freedom of expression

-

Institute calls for responsible social media usage among youths

-

Digital Rights: Policy enthusiast, Jere, advocates self-regulation as alternative to govt regulations

-

Sign language interpreter, Kunda, seeks inclusivity in media rights agenda

-

Sign language interpreter, Kunda, seeks inclusivity in media rights agenda (video)

-

Educationist challenges media freedom norms, cautions against misuse of freedom of expression

Strictly Personal

Air Peace, capitalism and national interest, By Dakuku Peterside

Published

1 week agoon

April 16, 2024

Nigerian corporate influence and that of the West continue to collide. The rationale is straightforward: whereas corporate activity in Europe and America is part of their larger local and foreign policy engagement, privately owned enterprises in Nigeria or commercial interests are not part of Nigeria’s foreign policy ecosystem, neither is there a strong culture of government support for privately owned enterprises’ expansion locally and internationally.

The relationship between Nigerian businesses and foreign policy is important to the national interest. When backing domestic Nigerian companies to compete on a worldwide scale, the government should see it as a lever to drive foreign policy, and national strategic interest, promote trade, enhance national security considerations, and minimize distortion in the domestic market as the foreign airlines were doing, boost GDP, create employment opportunities, and optimize corporate returns for the firms.

Admitted nations do not always interfere directly in their companies’ business and commercial dealings, and there are always exceptions. I can cite two areas of exception: military sales by companies because of their strategic implications and are, therefore, part of foreign and diplomatic policy and processes. The second is where the products or routes of a company have implications for foreign policy. Air Peace falls into the second category in the Lagos – London route.

Two events demonstrate an emerging trend that, if not checked, will disincentivize Nigerian firms from competing in the global marketplace. There are other notable examples, but I am using these two examples because they are very recent and ongoing, and they are typological representations of the need for Nigerian government backing and support for local companies that are playing in a very competitive international market dominated by big foreign companies whose governments are using all forms of foreign policies and diplomacy to support and sustain.

The first is Air Peace. It is the only Nigerian-owned aviation company playing globally and checkmating the dominance of foreign airlines. The most recent advance is the commencement of flights on the Lagos – London route. In Nigeria, foreign airlines are well-established and accustomed to a lack of rivalry, yet a free-market economy depends on the existence of competition. Nigeria has significantly larger airline profits per passenger than other comparable African nations. Insufficient competition has resulted in high ticket costs and poor service quality. It is precisely this jinx that Air Peace is attempting to break.

On March 30, 2024, Air Peace reciprocated the lopsided Bilateral Air Service Agreement, BASA, between Nigeria and the United Kingdom when the local airline began direct flight operations from Lagos to Gatwick Airport in London. This elicited several reactions from foreign airlines backed by their various sovereigns because of their strategic interest. A critical response is the commencement of a price war. Before the Air Peace entry, the price of international flight tickets on the Lagos-London route had soared to as much as N3.5 million for the economy ticket. However, after Air Peace introduced a return economy class ticket priced at N1.2 million, foreign carriers like British Airways, Virgin Atlantic, and Qatar Airways reduced their fares significantly to remain competitive.

In a price war, there is little the government can do. In an open-market competitive situation such as this, our government must not act in a manner that suggests it is antagonistic to foreign players and competitors. There must be an appearance of a level playing field. However, government owes Air Peace protection against foreign competitors backed by their home governments. This is in the overall interest of the Nigerian consumer of goods and services. Competition history in the airspace works where the Consumer Protection Authority in the host country is active. This is almost absent in Nigeria and it is a reason why foreign airlines have been arbitrary in pricing their tickets. Nigerian consumers are often at the mercy of these foreign firms who lack any vista of patriotism and are more inclined to protect the national interest of their governments and countries.

It would not be too much to expect Nigerian companies playing globally to benefit from the protection of the Nigerian government to limit influence peddling by foreign-owned companies. The success of Air Peace should enable a more competitive and sustainable market, allowing domestic players to grow their network and propel Nigeria to the forefront of international aviation.

The second is Proforce, a Nigerian-owned military hardware manufacturing firm active in Rwanda, Chad, Mali, Ghana, Niger, Burkina Faso, and South Sudan. Despite the growing capacity of Proforce in military hardware manufacturing, Nigeria entered two lopsided arrangements with two UAE firms to supply military equipment worth billions of dollars , respectively. Both deals are backed by the UAE government but executed by UAE firms.

These deals on a more extensive web are not unconnected with UAE’s national strategic interest. In pursuit of its strategic national interest, India is pushing Indian firms to supply military equipment to Nigeria. The Nigerian defence equipment market has seen weaker indigenous competitors driven out due to the combination of local manufacturers’ lack of competitive capacity and government patronage of Asian, European, and US firms in the defence equipment manufacturing sector. This is a misnomer and needs to be corrected.

Not only should our government be the primary customer of this firm if its products meet international standards, but it should also support and protect it from the harsh competitive realities of a challenging but strategic market directly linked to our national military procurement ecosystem. The ability to produce military hardware locally is significant to our defence strategy.

This firm and similar companies playing in this strategic defence area must be considered strategic and have a considerable place in Nigeria’s foreign policy calculations. Protecting Nigeria’s interests is the primary reason for our engagement in global diplomacy. The government must deliberately balance national interest with capacity and competence in military hardware purchases. It will not be too much to ask these foreign firms to partner with local companies so we can embed the technology transfer advantages.

Our government must create an environment that enables our local companies to compete globally and ply their trades in various countries. It should be part of the government’s overall economic, strategic growth agenda to identify areas or sectors in which Nigerian companies have a competitive advantage, especially in the sub-region and across Africa and support the companies in these sectors to advance and grow to dominate in the African region with a view to competing globally. Government support in the form of incentives such as competitive grants ,tax credit for consumers ,low-interest capital, patronage, G2G business, operational support, and diplomatic lobbying, amongst others, will alter the competitive landscape. Governments and key government agencies in the west retain the services of lobbying firms in pursuit of its strategic interest.

Nigerian firms’ competitiveness on a global scale can only be enhanced by the support of the Nigerian government. Foreign policy interests should be a key driver of Nigerian trade agreements. How does the Nigerian government support private companies to grow and compete globally? Is it intentionally mapping out growth areas and creating opportunities for Nigerian firms to maximize their potential? Is the government at the domestic level removing bottlenecks and impediments to private company growth, allowing a level playing field for these companies to compete with international companies?

Why is the government patronising foreign firms against local firms if their products are of similar value? Why are Nigerian consumers left to the hands of international companies in some sectors without the government actively supporting the growth of local firms to compete in those sectors? These questions merit honest answers. Nigerian national interest must be the driving factor for our foreign policies, which must cover the private sector, just as is the case with most developed countries. The new global capitalism is not a product of accident or chance; the government has choreographed and shaped it by using foreign policies to support and protect local firms competing globally. Nigeria must learn to do the same to build a strong economy with more jobs.

Strictly Personal

This is chaos, not governance, and we must stop it, By Tee Ngugi

Published

2 weeks agoon

April 10, 2024

The following are stories that have dominated mainstream media in recent times. Fake fertiliser and attempts by powerful politicians to kill the story. A nation of bribes, government ministries and corporations where the vice is so routine that it has the semblance of policy. Irregular spending of billions in Nairobi County.

Billions are spent in all countries on domestic and foreign travel. Grabbing of land belonging to state corporations, was a scam reminiscent of the Kanu era when even public toilets would be grabbed. Crisis in the health and education sectors.

Tribalism in hiring for state jobs. Return of construction in riparian lands and natural waterways. Relocation of major businesses because of high cost of power and heavy taxation. A tax regime that is so punitive, it squeezes life out of small businesses. Etc, ad nauseam.

To be fair, these stories of thievery, mismanagement, negligence, incompetence and greed have been present in all administrations since independence.

However, instead of the cynically-named “mama mboga” government reversing this gradual slide towards state failure, it is fuelling it.

Alternately, it’s campaigning for 2027 or gallivanting all over the world, evoking the legend of Emperor Nero playing the violin as Rome burned.

A government is run based on strict adherence to policies and laws. It appoints the most competent personnel, irrespective of tribe, to run efficient departments which have clear-cut goals.

It aligns education to its national vision. Its strategies to achieve food security should be driven by the best brains and guided by innovative policies. It enacts policies that attract investment and incentivize building of businesses. It treats any kind of thievery or negligence as sabotage.

Government is not a political party. Government officials should have nothing to do with political party matters. They should be so engaged in their government duties that they literally would not have time for party issues. Government jobs should not be used to reward girlfriends and cronies.

Government is exhausting work undertaken because of a passion to transform lives, not for the trappings of power. Government is not endless campaigning to win the next election. To his credit, Mwai Kibaki left party matters alone until he had to run for re-election.

We have corrupted the meaning of government. We have parliamentarians beholden to their tribes, not to ideas.

We have incompetent and corrupt judges. We have a civil service where you bribe to be served. Police take bribes to allow death traps on our roads. We have urban planners who plan nothing except how to line their pockets. We have regulatory agencies that regulate nothing, including the intake of their fat stomachs.

We have advisers who advise on which tenders should go to whom. There is no central organising ethos at the heart of government. There is no sense of national purpose. We have flurries of national activities, policies, legislation, appointments which don’t lead to meaningful growth. We just run on the same spot.

Tee Ngugi is a Nairobi-based political commentator

EDITOR’S PICK

Tanzania’s auto-tech startup Spana is simplifying car maintenance— CEO

Tanzania’s auto-tech startup, Spana, has developed a mobile application for a bouquet of automobile services, enabling individual car owners and...

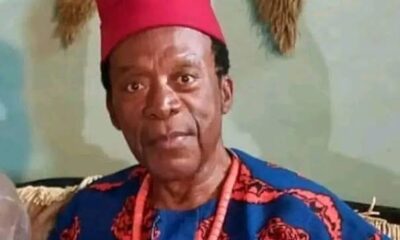

Nollywood thrown into mourning as another veteran actor Zulu Adigwe passes on

The Nigerian movie industry, popularly known as Nollywood, has once again been thrown into mourning with the death of veteran...

Zambian FA boss, Gen.Sec arrested over alleged laundering of K341,902

President of the Football Association of Zambia (FAZ), Andrew Kamanga, has been arrested along with the Secretary-General and two other...

Luapula businessman, Munsanje, reflects on media freedoms and freedom of expression

As stakeholder engagement intensifies regarding the ongoing project to amplify voices on media freedom, freedom of expression, and digital rights,...

World Bank stops tourism fund to Tanzania’s Ruaha park. Here’s why

A spokesperson for the World Bank said on Wednesday that the lender had stopped all new payments from a $150...

‘It would be risky to release Binance executive from custody risky’, Nigerian govt says

Nigeria’s anti-corruption agency, the Economic and Financial Crimes Commission (EFCC), believes admitting the detained executive of cryptocurrency firm, Binance Holdings...

President de Sousa insists Portugal must ‘pay costs’ of slavery, colonial crimes

Following recent conversations around reparations to countries with colonial heritage, Portuguese President, Marcelo Rebelo de Sousa, has added his voice...

Nigeria’s antigraft agency EFCC may try 300 forex racketeers

The Economic and Financial Crimes Commission (EFCC), Nigeria’s anti-corruption body, could go after 300 forex criminals who trade on a...

Institute calls for responsible social media usage among youths

Smart Zambia Institute has reiterated the importance of youths to use social media responsibly. Senior Business Applications Officer at the...

Digital Rights: Policy enthusiast, Jere, advocates self-regulation as alternative to govt regulations

Copperbelt businessman and mining policy advocate, George Jere, has highlighted the importance of self-regulation in the expanding digital media landscape,...

Trending

-

Musings From Abroad20 hours ago

Musings From Abroad20 hours agoPresident de Sousa insists Portugal must ‘pay costs’ of slavery, colonial crimes

-

Metro2 days ago

Metro2 days agoNigerian govt shuts Chinese supermarket over ‘no-Nigerian shopper’ allegation

-

Culture2 days ago

Culture2 days agoEgypt reclaims 3,400-year-old stolen statue of King Ramses II

-

VenturesNow2 days ago

VenturesNow2 days agoNigeria wants $2.25 billion World Bank loan